The 2025 US cement industry report reveals a dynamic sector navigating growth opportunities amid economic pressures. With infrastructure investments and sustainability demands shaping the landscape, this comprehensive analysis explores market trends, regional hotspots, and future projections. As construction rebounds, cement remains a cornerstone of America’s building boom.

Key Findings from the 2025 United States Cement Industry Report

The US cement industry continues to evolve. Recent data shows resilience despite challenges like fluctuating raw material costs and supply chain disruptions. Experts highlight how federal policies and technological advances are driving change.

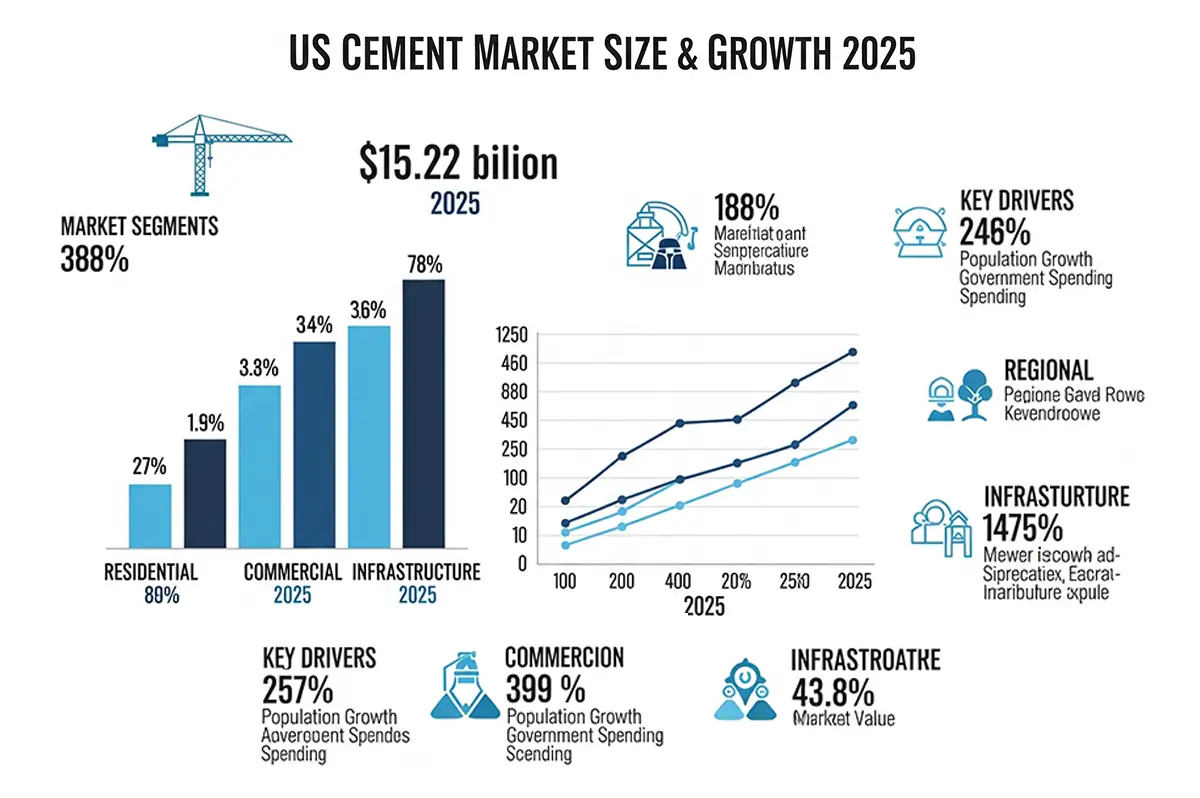

Market Size and Projected Annual Growth Rate

The US cement market reached approximately $18.7 billion in 2024. For 2025, projections vary based on volume and value metrics. One report forecasts a 4.5% annual growth in market value, potentially hitting $15.22 billion, driven by rising prices and demand in key sectors. However, cement consumption by volume may dip by 1.6%, reflecting high interest rates impacting residential construction.

This discrepancy arises from price increases offsetting lower volumes. Average cement prices are expected to rise to around $140 per metric ton in early 2025. Portland cement, the dominant type, accounts for over 90% of production. The industry produced about 84 million tons in 2024, with slight adjustments anticipated for 2025.

Growth rates could stabilize at 2-3% CAGR through 2030 if economic conditions improve. Factors like labor shortages and energy costs will influence outcomes. Businesses should monitor these metrics closely for strategic planning.

Impact of National Infrastructure Projects on Demand

National infrastructure projects significantly boost cement demand. The Infrastructure Investment and Jobs Act (IIJA) continues to fund highways, bridges, and public works, injecting billions into construction. In 2025, these initiatives are projected to sustain demand despite overall consumption dips.

Emerging trends include AI data center construction, requiring up to 1 million metric tons of cement by 2028. Data centers alone accounted for 4.4% of US electricity use in 2024, driving concrete-intensive builds. Public segments may see a 1.5% drop in shipments from 2024 levels, but long-term optimism persists due to tech infrastructure.

Trade policies and tariffs could add uncertainty. Yet, federal investments in sustainable infrastructure help mitigate risks. Contractors benefit from these projects, which prioritize durable, high-performance cement.

The Rise of Green Cement: Sustainability Trends to Watch

Sustainability dominates the cement agenda. As carbon regulations tighten, the industry shifts toward eco-friendly alternatives. This trend aligns with global net-zero goals.

What is Green Cement and Why Does it Matter?

Green cement reduces carbon emissions through innovative production methods. It uses recycled materials like fly ash or slag, cutting CO2 output by up to 80% compared to traditional Portland cement. Why does it matter? Cement production accounts for 8% of global emissions. Green variants support circular economy principles, reusing industrial byproducts.

In the US, policies like carbon pricing encourage adoption. It matters for builders aiming for LEED certification or complying with new environmental standards. Green cement maintains strength while lowering environmental impact.

Market Demand and Adoption Rates for Sustainable Concrete Solutions

Demand for green cement surges. The global market, valued at $37.76 billion in 2024, is expected to grow at 6.1% CAGR to $50.24 billion by 2030. In North America, it’s projected to reach $2.32 billion by 2033.

Adoption rates climb as costs decrease. About 20-30% of new projects incorporate sustainable concrete in 2025. Challenges include supply limitations, but innovations like low-carbon clinker boost availability. Builders report 15-20% higher initial costs, offset by long-term savings and incentives.

Trends show Asia-Pacific leading, but US growth accelerates with federal green building mandates. Expect wider adoption in commercial and infrastructure sectors.

Regional Analysis: Hotspots for Cement Consumption

Cement consumption varies by region. Urban growth and infrastructure needs create hotspots. Analyzing these helps stakeholders target opportunities.

Examining Growth in the Philadelphia Metropolitan Area

Philadelphia emerges as a key hotspot. Pennsylvania ranks sixth in US cement production, supporting local demand. The area’s construction boom, including I-95 upgrades, drives consumption.

In 2025, projects like bridge interchanges and viaducts require substantial concrete. Economic developments, such as new manufacturing facilities, add to demand. Philadelphia’s occupancy rates above 93% signal stable real estate growth, indirectly boosting cement use.

Local costs reflect this: Portland cemeLocal concrete contractorsnt prices align with national averages, influenced by regional supply chains. Sustainability focus in urban planning further promotes green cement here.

Other Key Markets Driving National Trends

Beyond Philadelphia, Texas and California lead consumption. Texas benefits from energy sector builds and population growth. California emphasizes seismic-resistant infrastructure.

The Midwest sees steady demand from industrial revitalization. Southeast hotspots like Florida grow due to housing and tourism projects. Overall, urban metros account for 60% of national consumption, with AI data centers emerging in states like Virginia and Oregon.

These markets drive trends toward modular construction and resilient materials.

Future Forecast: What to Expect in the US Cement Market Beyond 2025

Looking ahead, the US cement market shows promise. Consumption may rebound in 2026, with a projected pick-up post-2025 dips. By 2030, North American volume could reach 251.97 million tons, at a 4.42% CAGR.

Market value might hit $26 billion by 2031, growing at 6% CAGR. Decarbonization remains key, with policies pushing low-carbon tech. Expect innovations in expansive cement and AI-optimized production.

Challenges include trade tensions and material shortages. Yet, infrastructure and tech sectors provide growth avenues. The industry must adapt to sustainability for long-term success.

FAQ

Infrastructure projects, including AI data centers and federal investments, primarily drive growth despite consumption dips.

Green cement demand boosts innovation, with market growth at 6.1% CAGR, influencing sustainable building practices.

High interest rates, trade uncertainties, and rising energy costs pose challenges, potentially reducing volumes.

They will sustain demand, especially for public works, offsetting residential slowdowns with billions in funding.

Philadelphia, Texas, and California lead, driven by urban development and infrastructure upgrades.