Construction market trends in 2025 continue to evolve amid economic shifts and policy changes. Drawing from insights like those in Skanska’s recent reports, this summer analysis examines housing demand, material pricing, and sector forecasts. Builders face a mixed landscape of steady growth in public projects and caution in residential areas. As tariffs and supply chains influence costs, staying informed helps navigate these dynamics effectively.

Analyzing the Current Housing Demand and Its Impact

Housing remains a cornerstone of construction activity. Yet, mid-2025 shows a cooling market. Buyers hesitate due to high rates, leading to longer sales times and rising inventory. This slowdown ripples through the industry, affecting material needs and project timelines.

Key Housing Market Indicators for Mid-2025

The typical US home now sits on the market for 60 days, up a full week from last year. Inventory gains have slowed, with pending sales and new listings dipping in August. Home values hover around $363,505, with a modest 0.2% yearly rise. Regional variations stand out: the South and West see softening prices, while the Northeast and Midwest hold steady.

Affordability challenges persist. About 82.8% of homeowners lock in rates below 6%, down from 92.7% in mid-2022. This “lock-in effect” keeps sellers sidelined, limiting supply. Experts predict subdued growth of 3% or less through year-end, with more sales but flatter price increases over the next five years.

How Housing Trends Influence Broader Construction

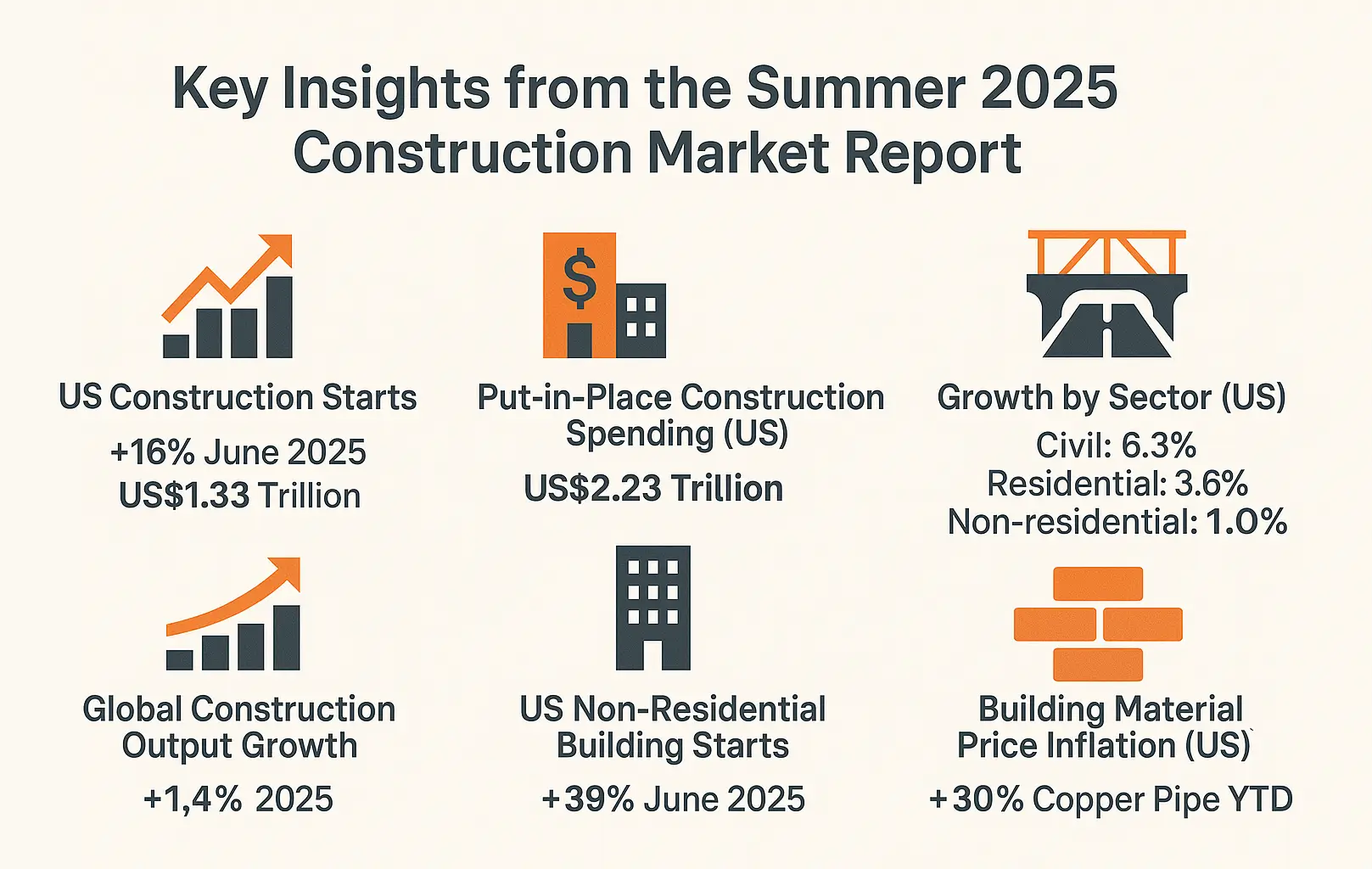

Lower housing demand curbs residential starts, projected at a 0.9% uptick to $576 billion in the first half of 2025. Non-residential segments, like manufacturing, pick up the slack, with total starts reaching $1.33 trillion in June—a 16% jump. Yet, overall put-in-place spending grows just 3.3% to $2.23 trillion for the year.

This shift boosts demand for commercial renovations and infrastructure. Public projects provide stability, while private residential work faces headwinds from interest rates. Builders must adapt, focusing on mixed-use developments that blend housing with commercial spaces.

The Real Story Behind Drywall and Gypsum Pricing Trends

Drywall and gypsum boards form essential building blocks. Pricing has stabilized after years of volatility, thanks to steady supply and moderated demand. Skanska’s summer report notes availability remains reliable, with no major disruptions.

Current Pricing Landscape and Stability Factors

Sheetrock costs $10 to $20 per sheet, or $0.30 to $0.50 per square foot, holding firm into 2025. Gypsum producer prices sit at around 363.747 on the index, unchanged month-over-month but up slightly from last year. The global gypsum drywall market hits $29.59 billion this year, growing to $38.34 billion by 2034 at a steady pace.

Factors like recycled content and efficient production keep prices in check. Insulation trends tie in, with stable short-term costs despite potential upticks from new home sales. No sharp rises appear on the horizon, offering relief for interior fit-outs.

Future Projections for Drywall Costs

Expect modest increases of 2-3% through 2025, driven by raw material tweaks and sustainability mandates. The sector could reach $34.16 billion, fueled by green building booms. Technological advances, like low-VOC boards, add value without spiking prices.

Builders benefit from this predictability. Stockpiling makes sense for larger projects, but just-in-time ordering suits smaller jobs. Overall, drywall trends support a balanced market.

Fluctuations in Concrete Costs: What’s Driving the Changes?

Concrete prices show more variability than drywall. Tariffs and supply issues create ups and downs, impacting budgets across projects. Skanska highlights a 9% year-over-year rise, urging caution in planning.

Recent Cost Trends and Tariff Impacts

Ready-mix concrete averages $120 to $150 per cubic yard, with nationwide figures at $166.39 for the first half of 2025. Cement prices hit $96 per metric ton in Q2, reflecting steady demand. A 1.2% year-to-date increase marks January, but Q1 saw a 1.65% dip—a brief relief.

Tariffs play a big role. A potential 25% on imports could add $32 per ton to cement, pushing loads from $130 to $162. Steel tariffs at 50% indirectly affect rebar costs, compounding the issue. Global events and energy prices add layers of uncertainty.

Strategies for Managing Concrete Price Volatility

Lock in supplier contracts early to hedge against swings. Alternative materials, like fly ash blends, cut costs without sacrificing quality. Monitor federal indices for timely adjustments. Diversifying sources helps too, blending domestic and imported options.

These steps build resilience. As infrastructure demands grow, smart management turns challenges into opportunities.

Overall, Summer 2025 Market Outlook

The construction market trends in 2025 point to tempered expansion. Total spending nears $2.23 trillion, with non-residential leading at 3% growth in starts. Employment adds 174,000 jobs, up 2.1%, though slowdowns loom. Tariffs could raise costs by 5%, per early projections.

Public investments sustain momentum, while residential lags. Regional hotspots like Philadelphia thrive on urban projects. Sustainability and tech integration offer bright spots amid caution.

Conclusion: Partner with PhillyTradeExperts for Your Construction Needs

Summer 2025’s construction market blends stability with uncertainty, from steady drywall prices to volatile concrete costs. Housing slowdowns challenge residential builders, but opportunities in infrastructure and commercial work abound. Adapting to these trends ensures success in a dynamic landscape.

At PhillyTradeExperts, we specialize in navigating these shifts for Philadelphia-area projects. Our team sources affordable, sustainable materials like drywall and concrete, while offering expert analysis to optimize your budget. Whether it’s housing renovations or large-scale builds, we’re here to help. Reach out today at [email protected] or call us to get started on your next venture.

FAQs

Growth slows to 3.3% overall, with non-residential starts up 16% but housing inventory rising and sales cooling.

Subdued demand extends market times to 60 days, curbing residential starts while boosting commercial focus.

Reliable supply, recycled innovations, and steady demand keep costs at $0.30-$0.50 per square foot.

Tariffs add up to 25% on imports, energy prices, and supply chains drive 9% yearly increases.

Lock in contracts, diversify suppliers, and monitor indices to manage volatility effectively.